|

Adaptive reuse projects and restaurants are the top targets for retail investors today. By Kelsi Maree Borland | October 29, 2018 at 04:00 AM Heslin Holdings has announced plans to invest $75 million in equity into retail assets over the next 12 months. The firm says that there are still plenty of opportunities in the retail market, despite headlines, particularly in adaptive reuse projects, restaurants and daily needs categories. Heslin will focus these investment dollars on growth markets West of Texas.

“Retail is being gentrified. It might have one use and then the next day is reused through adaptive reuse,” Matthew Heslin, principal and CEO with Heslin Holdings. “For example, now you are seeing a need for more last-mile distribution, and people are taking older grocery stores and turning them into distribution hubs for localized distribution. We look at it from a multitude of different views. Adaptive reuse of repurposing retail is one big opportunity. Next, the quick service restaurants and fast food is not going away, and every day household needs, including the dollar stores and the discounters, are doing well. We are focused on using those as part of our retail expansion.” While the firm sees opportunities in retail, the need to place remaining capital was the impetus for the 12-month, $75 million allocation. “We have capital left in our pipeline that we need to execute on,” explains Heslin. “So, it was driven both by capital allocation and opportunistic deals that are in front of us right now.” Heslin is seeking retail opportunities in growth markets west of Texas, and is specifically looking to markets with population and GDP growth and strong employment. “From a macro perspective, we are looking for stable markets with GDP growth, and that has stable employment, diversified GDP and population growth,” says Heslin. “Denver is a good example of that. It is a market with 50,000 millennials moving in and more than 1 million millennials in the market. It has biotech, technology, finance industries. That is a market in particular that we like.” The $75 million is equity will be paired with debt on a case-by-case basis. Heslin has the ability to purchase assets in all cash as well. “We have different opportunities to finance our deals,” says Heslin. “We do all-cash deals, or we do lines of credit, bridge financing and permanent financing. It depends on the asset and on our investors’ appetite. We use different financing options for different opportunities and assets.” Overall, Heslin says the firm is cautiously optimistic on the retail investment market, even with rising interest rates and an extended cycle. “There are opportunities in every cycle,” he says. “We are returning to normalized interest rates and cap rates, which means they will be rising over the near and long term. A prudent investor is going to be planning for that and underwriting to those eventualities. It is important to underwrite flat rents with inflationary expense growth.” Source: https://www.globest.com/2018/10/29/where-retail-investors-are-spending-money/?slreturn=20180930104323 It's no secret to Worcester residents that their city is booming - and now the the truth is even more widely known, thanks to NPR:

https://www.npr.org/2018/10/23/658263218/forget-oakland-or-hoboken-worcester-mass-is-the-new-it-town?utm_source=facebook.com&utm_medium=social&utm_campaign=npr&utm_term=nprnews&utm_content=2051 Worcester already has a lot to offer - culture, community, colleges, commerce - and it may soon have even more. The Telegram & Gazette reports on efforts to establish a Business Improvement District downtown: A group of downtown property owners is asking the City Council to allow the establishment of a Business Improvement District that would encompass roughly 78 acres downtown. Such a district, which is allowed under state law, would provide business and property owners with a legal mechanism for collecting and allocating self-imposed fees via an annual assessment. The money could be used to fund a variety of “public realm” improvements in the district, such as enhanced street sweeping, sidewalk power washing, sidewalk snow removal, landscaping, removing stickers and other paraphernalia from streetscape furniture, public safety enhancements, beautification projects and marketing. Read the full story here: https://www.telegram.com/news/20181015/bid-for-downtown-improvement-district-heads-to-worcester-council

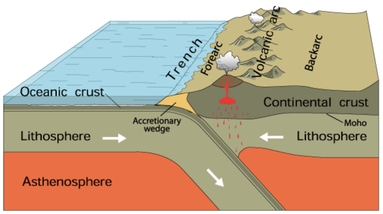

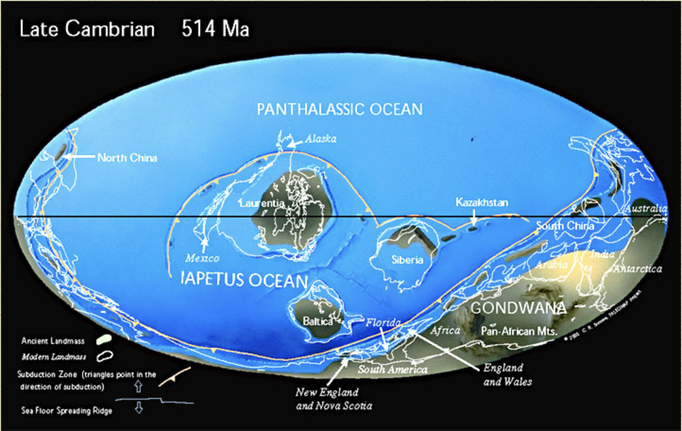

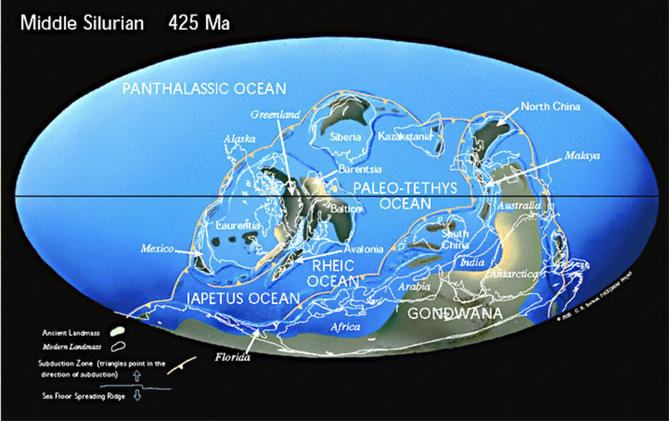

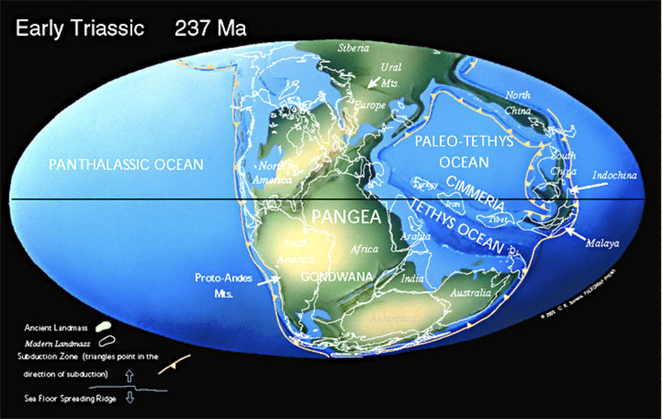

Subduction. Courtesy of USGS. Subduction. Courtesy of USGS. Imagine a world where South America is at the South Pole, Siberia, along the Tropic of Capricorn, and Greenland, at the Equator. In this world, Florida is a frigid strip of coast connecting South America and Africa. Canada bakes beneath a bright equatorial sun. The rest of North America is a scuba-diver's paradise – assuming scuba-divers numbered among the primitive, single-cell organisms that existed 550 million years ago. Welcome to the Late Precambrian, an era of dramatic geological change and the beginning of New England’s story. At this point, the earth was 3.5 billion years old. It had already experienced multiple episodes of continental drift, volcanism, and glaciation. The Grenville Mountain chain, formed during an earlier period of tectonic collision, had eroded. All that remained was a small layer of bedrock and a large amount of sediment that would eventually become western Massachusetts. Three major continents contained most of the planet’s land mass: Laurentia, Baltica, and the supercontinent Gondwana, whose coastline roiled with volcanic activity. The earthquakes and lava flows were symptoms of tectonic subduction (when one tectonic plate dives beneath another) and rifting (when two plates diverge). Over time, these subterranean stirrings formed the Avalon mountain range and Boston Rift Basin off the coast of present-day South America. We now call this region New England. As Earth entered the Cambrian Period, Avalon broke away from Gondwana. Sediments filled the rift basin and compressed into the Cambridge Argillite and Roxbury Conglomerate (puddingstone) rock formations underlying Greater Boston today. Between 430 and 390 million years ago, Avalon collided with Laurentia, forming the Northern Appalachians. This period of tectonic uplift coincided with rising oxygen levels and an explosion of multicellular life. Complex organisms spread across the globe as New England rose from the depths of the ocean. Over the succeeding eons, the planet’s crust continued to transform. The continents collided again 250 million years ago to form Pangaea, lifting the Appalachians to Himalayan heights, and then separated fifty million years later. This period of rifting created today’s continents and instigated more lava flows. We can still see evidence of this geological turbulence in the igneous and metamorphic rocks of Worcester County. Volcanic activity subsided as the continents drifted to their present locations. Massachusetts was thereafter shaped by deposition, weathering, and erosion. Temperatures rose, fell, and rose again, causing frequent glaciations that carved the Northeastern bedrock. Meanwhile, life evolved. The region was alternately submerged in shallow seas teeming with crustaceans and fish, and raised high and dry, a coastal forest where dinosaurs roamed. By the time Homo sapiens arrived in New England twelve thousand years ago, the region was a frozen tundra. The latest Ice Age scarred the landscape with eskers, dimpled it with kettle ponds, and pimpled it with erratics – a rugged topography that determined where humans settled, and upon which they would eventually unleash their transformative might.

The Architectural Heritage Foundation is thrilled to announce the launch of our Instagram and Twitter pages! Follow us:

Instagram: ahfboston Twitter: @AHFBoston The Aud featured again in a recent Telegram op-ed about renewed investment in Lincoln Square. The Worcester County Courthouse and former Boys Club, two vacant, historic buildings adjacent to the auditorium, are also slated for redevelopment. Nick Kotsopoulos writes: What is happening at the north end of downtown at Lincoln Square...is something that has the potential of being transformative for that part of the downtown, while also preserving three historic and architecturally significant buildings. A major gateway to the downtown, Lincoln Square has long had the unique distinction of being home to three white elephants: the former Worcester County Courthouse building, the former Lincoln Square Boys Club building and the Worcester Memorial Auditorium. All three buildings have been vacant and been long-neglected for years, and their futures appeared uncertain at best if not downright hopeless...But it appears that the pieces to the Lincoln Square puzzle are finally beginning to fall into place. The Architectural Heritage Foundation is pleased to announce the launch of the Aud restoration project Facebook page. We are excited to begin this next phase of community engagement. Follow and like our page at www.facebook.com/worcesteraud/ to stay up-to-date on project developments.

Yesterday we had the pleasure of hosting photographers Yves, Romain, and Alex at the Aud. They travelled all the way from Paris to photograph the Aud and other historic American theaters in need of restoration. For over ten years, they have been using art to call attention to these beautiful, endangered structures. Check out their work: http://www.marchandmeffre.com/theaters Thank you, Yves, Romain, and Alex! We look forward to seeing your pictures! |

AuthorArchitectural Heritage Foundation (AHF) is working to preserve and redevelop the Worcester Memorial Auditorium as a cutting-edge center for digital innovation. Archives

May 2022

Categories

All

|

RSS Feed

RSS Feed